At Dividend Geek our goal is to make it easy for you to safely and successfully invest to produce enough passive income that will enable you to retire financially independent. The fantastic thing about the Dividend Geek system is that it can be done by anyone! You don’t have to strike it rich by starting your own business, live on 25% of your income, learn to make real estate deals, or convince friends to join your MLM down-line. The principles and methods are simple, mathematically sound and time-tested. People who know this have been doing it successfully time and time again for over 100 years and anyone can do them today.

Put time on your side

Achieving financial freedom takes time but you don’t have to wait until you are 65 to retire. Anyone can do it if they will start early enough and allow enough time for the power of compounding to work. If you are just starting and have little or no retirement saving the magic number of years to compound your annual $5,500 IRA contribution is 30 years. With more start up investment capital you can shorten the time, but time is the strongest factor in compounding the longer the better.

Achieving financial freedom takes time but you don’t have to wait until you are 65 to retire. Anyone can do it if they will start early enough and allow enough time for the power of compounding to work. If you are just starting and have little or no retirement saving the magic number of years to compound your annual $5,500 IRA contribution is 30 years. With more start up investment capital you can shorten the time, but time is the strongest factor in compounding the longer the better.

Unfortunately, statistics show that most people don’t realize the necessity of planning and saving for retirement early in life. According to a study conducted by the U.S. Department of Commerce, only 5 percent of all Americans are financially independent at age 65. Also, 75 percent of all retirees are forced to depend on family, friends, and Social Security as their only sources of income. Don’t fall into these statistics start saving and investing NOW for your retirement. Don’t wait! The sooner in life you start the better, time is your greatest ally and most valuable asset.

Where to invest?

Where to invest?

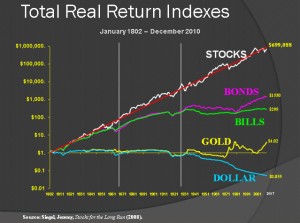

That said, historically their are just two types of investment assets real estate and ownership in corporate America “stocks” that generate a high enough rate of return to overcome inflation, taxes, and expenses to achieve financial freedom. We prefer stocks because of their liquidity and low overhead (truly passive income).

Longer Time Horizon = Lower Downside Risk

Fifty years ago individual investors held stocks an average of 5-10 years, but with today’s get rich quick mentality they hold onto their shares less than a year. The trigger for selling and/or buying is often short-term performance chasing: buying recent hot-performing funds or asset classes and selling recent losers. Mixing short holding periods with a high volatility stock market is a receipt for disaster. Combine that with all of the conflicting opinions and misinformation and it’s no wonder why so many people are leery or skeptical of investing in the stock market.

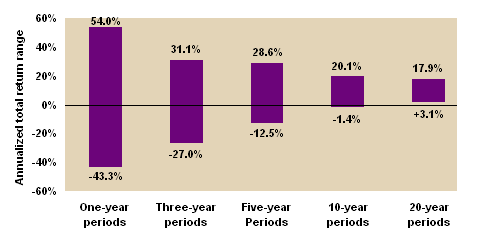

The fact is over long time horizons the stock market has consistently produced positive returns. In the chart below you can see the power of long holding periods when it comes to minimizing downside risk.

The longer you extend your time horizon, the less likely you’ll experience a loss over that holding period. Don’t let the negative opinions, dogma and rhetoric about the stock market keep you out. The numbers don’t lie – when investing long-term the stock market has consistently produced outstanding results that have out performed all other investment asset classes.

The longer you extend your time horizon, the less likely you’ll experience a loss over that holding period. Don’t let the negative opinions, dogma and rhetoric about the stock market keep you out. The numbers don’t lie – when investing long-term the stock market has consistently produced outstanding results that have out performed all other investment asset classes.

Take control of your money

Many people just don’t know what to do, or where to start “it’s all so complicated, confusing and intimidating;” so they either do nothing, or hand over their money to professionals and mutual funds to be eaten away in commissions and fees. The first step to be successful is for you to take control of your money. Don’t worry Dividend Geek has all of the tools and resources to make it easy for you to successful long-term investor, so you can keep your expenses low.

The Investment Killers

There are five fundamental “Investment Killers” that prevent investors from earning a high enough return to achieve financial freedom.

- Taxes

- Inflation

- Commissions, Fees, and Expenses

- Human Emotions

- Lack of Knowledge (or a successful plan)

Fortunately there is help. The Dividend Geek system not only eliminates all of the investment killers in one simple system, but it is the culmination of 20 years of investment experience that I believe is the single best way achieve investing success. There’s really nothing new all of these investment principles have been practiced for years. What is unique is that we have created a complete long-term investing system using the principle of dividend growth at its foundation.

The end result is Dividend Geek… a system that enables you to overcome all of the obstacles (inflation, taxes, fees, human emotion, etc.) to achieve financial freedom. Best of all anyone can do this and it’s right here for you to use.

How It’s Done

Open a Roth IRA and contribute $458.33 a month ($5500/yr). Invest in a diversified portfolio of 10 to 20 of the best dividend growth stocks that average a 3.5% initial dividend yield and increase their dividend payment by 10% a year (don’t worry we have all of this figured out for you).

The powerful double compounding affect of companies that raise their dividend payment each year and reinvesting your dividends for 30 years will amass a portfolio worth over two million dollars. After 30 years stop your contribution and dividend reinvestment and receive cash payments of $460,000 a year in dividend income. During this time period inflation will reduce this to the equivalent of $230,000 a year in today’s dollar purchasing power to meet your living expenses and more. Going forward the 10% increase in dividend payments will allow your income to stay ahead of inflation.

Ideally you never sell the principle, when you no longer require the income you have the principle transferred into a trust account so the income can continue to benefit your family and or your favorite charity. The principle is available as a back up in the case of an emergency.

What You Need

- Time – the longer the better, 30 years is ideal

- Money – $458.33 a month

- Discipline and Patience – commitment to follow the plan

- The Dividend Geek Investment System

Benefits

You can safely achieve financial freedom using the Dividend Geek investment system that is structured to maximize the powerful combination of the best conservative time-tested investment principles. Following this simple yet powerful investment strategy for 30 years will turn $458.33 a month into a $2 million portfolio that generates $460,000 a year in passive income ($230,000 adjusted for inflation) which will be more than enough money to enjoy the world, reduce potential liabilities on society, and help many people today and for generations to come.