Geek Score

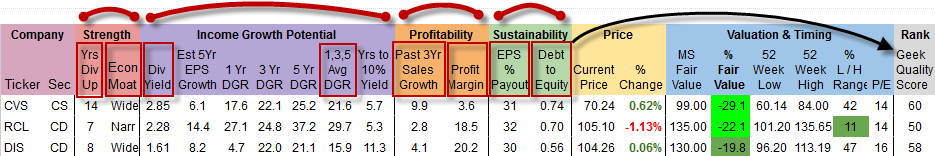

The ‘Geek Score’ ranking system accesses the Dividend Growth Investing (DGI) qualities of a company. The score is displayed in the far right column of each screener table. The best possible score is 100 points.

Points are awarded evenly (25% each) across the following four Dividend Growth Investing categories:

- Strength

- Income Growth Potential

- Profitability

- Sustainability

Each of the four categories has two metrics for a total of eight with a maximum of 12.5 points for each metric.

Listed below in the red boxes are the eight metrics that make up the Geek Quality Score shown in the far right column.

The full point allocation breakdown for each of the eight metrics is as follows:

Strength

- Years Dividend Up

- 25+ years = 12.5 points

- 20 – 24 years = 10

- 15 – 19 years = 7.5

- 10 – 14 years = 5

- 5 – 9 years = 2.5

- less than 5 = 0 (zero)

- Economic Moat

- Wide = 12.5 points

- Narrow = 7.5

- None = 2.5

Income Growth Potential

- Dividend Yield

- 4.5%+ yield = 12.5 points

- 4.0 – 4.4% yield = 10

- 3.5 – 3.9% yield = 7.5

- 3.0 – 3.4% yield = 5

- 2.5 – 2.9% yield = 2.5

- less than 2.5% = 0 (zero)

- 1, 3, 5 Year Average Dividend Growth Rate (DGR)

- 15%+ DGR = 12.5 points

- 12.5 – 14.9% DGR = 10

- 10 – 12.4% DGR = 7.5

- 7.5 – 9.9% DGR = 5

- 5 – 7.4% DGR = 2.5

- less than 5% = 0 (zero)

Profitability

- 3-Year Sales Growth (source Morningstar)

- 20%+ = 12.5 points

- 15 – 19.9% = 10

- 10 – 14.9% = 7.5

- 5 – 9.9% = 5

- 0 – 4.9 – 2.5

- less than zero = 0 (note to listen to Elvis Costello song)

- Profit Margin (trailing 12 month; source Morningstar)

- 40%+ = 12.5 points

- 30 – 39.9% = 10

- 20 – 29.9% = 7.5

- 10 – 19.9% = 5

- 0 – 9.9% = 2.5

- less than zero = 0

Sustainability

- EPS Payout Ratio (note: for REITs FFO payout ratio is used)

- 35% or less = 12.5 points

- 45 – 34.9% = 10

- 55 – 44.9% = 7.5

- 65 – 54.9% = 5

- 75 – 65.9% = 2.5

- more than 75 = 0

- Debt to Equity

- 0.25 or less = 12.5 points

- 0.5 – 0.249 = 10

- 0.75 – 0.499 = 7.5

- 1.00 – 0.749 = 5

- 1.6 – 0.99 = 2.5

- more than 1.6 = 0 (zero)