TXN Lowers Q4 Guidance – Dip Opportunity?

Texas Instruments (TXN) is down -11.0% after reporting Q3 earning after hours today. Just missing analysis expectations of EPS of $1.42 (they came in at $1.40) didn’t help but was not the major factor in the large decline. It was their lowering of Q4 guidance. Here is an article on the details – in short buyers are holding back from making purchases due to trade war with China. My thoughts are this might take a year or so to resolve, but when it does there should be a release of pent up demand. I don’t believe this is a fundamental problem with TXN.

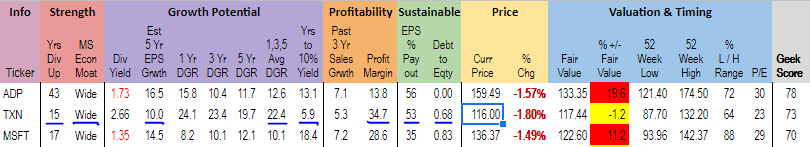

I have owned TXN for many years (my cost basis is $47.80 which gives me a 6.44% yield on cost}. I consider TXN to be one of the best dividend growth stocks in the tech sector. If the stock drops to $116.00 when the market opens that would put it about fair value and the dividend yield at 2.66%. It has excellent DGI Geek stats (underlined in blue):

Filed in: Company News

“If the stock drops to $116.00 when the market opens that would put it about fair value and the dividend yield at 2.66%.”

seems you are still calculating with the old dividend of 0.77 instead of the already published of 0.90 for the November payout

Hi Boekel!

Nice catch. You are correct I have updated the screeners to reflect TXN’s $0.90 quarterly dividend payment, which calculates to a 3.10% annual yield at $116 price.