What is the First Step to Financial Freedom?

This post is the first of a four step ‘Financial Freedom Kick-Starter Tutorial’ that I am working on. The objective is to provide everything you need to know to start your journey to financial freedom. It will be packed with thirty years of investing experience boiled down into a simple easy-to-follow program. Ready? Here we go!

Step #1

Commit Yourself to live the 3 Keys to Financial Freedom!

Do these three things to put yourself on the path to financial independence! Are you ready! This is BIG!

- Avoid debt

- Spend less than you earn

- Invest the difference (in assets that produce a growing stream of investment income)

I know it’s just good ol’ common sense, but many people struggle putting this into practice. In fact, the recent partial government shutdown brought to attention that 78% of Americans live paycheck to paycheck.

Many people just don’t know what to do, or where to start to invest towards retirement “it’s all so complicated, confusing and intimidating;” so they either do nothing, or hand over their money to professionals and mutual funds to be eaten away in commissions and fees.

The first two keys to be successful is for you to take control of your money by avoiding debt and spending less than you earn, which I leave up to you. If these are not under control, let’s face it you won’t have any money to invest. Work on getting your personal finances in order and your spending in check.

The third key “invest the difference” is to learn how to become a successful income investor. Helping you build a safe growing income stream that you can live on is what Dividend Geek is all about. Don’t worry the rest of the series will cover what you need to know and do to build a growing stream of investment income – I call it my money machine, and you can build one too!

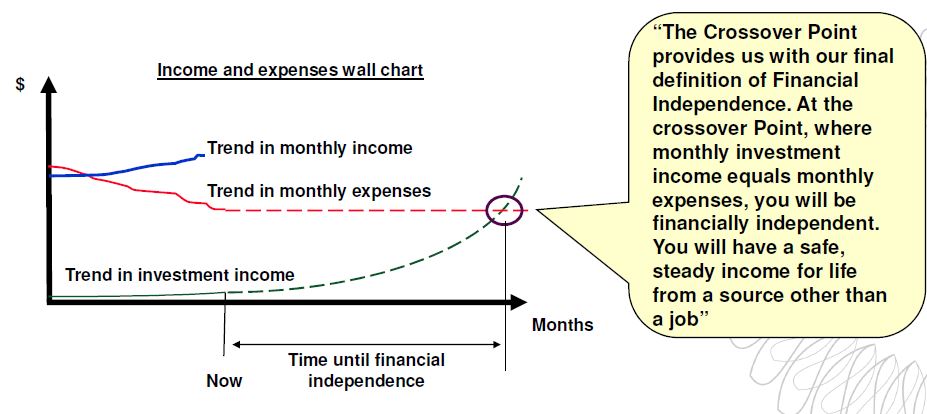

The Crossover Point

Financial freedom can mean different things to people, but I believe this is the the best definition expressed in a math formula:

When Investment Income is > Expenses = Financial Freedom

This is also called the “the crossover point.” When your investment income meets or exceeds your expenses (crossover point) you can choose to stop trading your time for money (work) and live off of your investment income. Source: From the authors of ‘Your Money or Your Life.’

Many people in their 30’s, 40’s, and 50’s, years before the traditional retirement age of 65 are living off of their investment income. The age at which you reach your crossover point depends on you and the choices you make. For most people getting started is the hardest step. Ironically, getting started is the #1 key to success due to the effect of compounding where the more time you give your investments, the more you are able to accelerate your income potential.

Keep checking back for the rest of the series. For now your first assignment is to commit yourself to live the financial freedom formula, take control of your money and prepare to invest for your future! I promise that when you do – it’s life changing! It was for me.

![]()

Filed in: Dividend Growth Investing