Dividend Geeks Prospects of the Week – July 22, 2018

This week I’m reviewing the Fast Dividend Growth and High Velocity Dividends screeners. I’m thinking of combining these two screens they are very similar in that they both track dividend growth stocks with high dividend growth rates and typically lower initial dividend yields. I like to own a combination of both these high dividend growth rate companies, and the more mature slower growing, cash cow type of companies generally found in the Dividend Kings and Champions screeners. Having a balance of both types of dividend growth stocks allows you to build a portfolio that averages a 4% dividend yield and a 10% dividend growth rate, which are my personal targets, of course your targets will vary depending on your personal retirement situation.

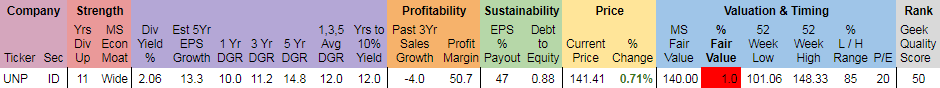

Looking through our High Velocity Dividends screener I found the following undervalued or near fair value stocks trading at recent support levels. The first company that looked interesting is Union Pacific Corp (UNP) the freight hauling railroad that operates 8,500 locomotives over 32,100 route-miles in 23 states west of Chicago and New Orleans.

Below I provide both my thoughts on each company’s long-term dividend growth investing potential (fundamental’s), as well as some short-term technical analysis on their timing.

Union Pacific Corp (UNP)

Fair value is $140, current price $141.41 which is just 1% above fair value. UNP has increased their annual dividend payments for 11 consecutive years. Their dividend growth rate has consistently been in double-digits with their 1, 3, and 5 year averages having a combined average of 12%. If UNP’s estimated 5 year EPS growth rate of 13.3% holds true there’s very little risk that they would suspend or cut their dividend as they are growing earning faster than the growth of the dividend payout, plus they are only paying out 47% of earnings in the form of dividends. Sales growth is down -4.0 over the past three years, due to the decline in coal car shipments, but UNP has been able to cut costs faster than the reduction in revenue, to keep margins intact. I like the Wide economic moat rating, and the 2% yield is okay. With a 2% current yield and assuming their 12% DGR continues forward an investment today would produce a 10% yield on cost in 12 years.

Technical Analysis

- Pass resistance level of $140 that was breached in May is now forming a new support level

- Price channel trending upwards past 2.5 years

- Current price just below bottom of channel

- Entry point range of $140 – $138

The rest of this article is exclusive content for Dividend Geek members.

If you are a member just login and then click ‘Prospects’ on the top menu bar. Today’s article at the top of the list. If you are not a member you can sign up by clicking ‘Join Today!‘

![]()

Filed in: Dividend Growth Investing • Uncategorized

I love the breakdown of what you are looking at including previous resistance & new found support. Thank you like always for your hard work & effort in helping all of us reach financial stability & independence.