18 Core Dividend Growth Stocks to Strengthen Your Portfolio

Dividend growth investing by its nature is a conservative long-term investing methodology. But, with all of the recent uncertainty in the world (maybe this election cycle is getting to me) I have felt the need to bolster my portfolio with additional strength. I decided to review the companies listed in my current prospective dividend growth stock watchlists; both the ‘Champions & Contenders’ watchlist and the ‘Challengers’ watchlist to identify the strongest DGI stocks.

The first step, in my search is for companies with strong competitive advantages (wide economic moats) and solid future long-term growth prospects. Great businesses that will weather potential economic or Geo-political storms, with the ability to continue to return value to shareholders by increasing their dividend payments every year. Timing, or the current price of the stock compared to its fair value was not considered, well this is the last step. In other words, if price didn’t matter what are the strongest dividend growth companies that I would love to own.

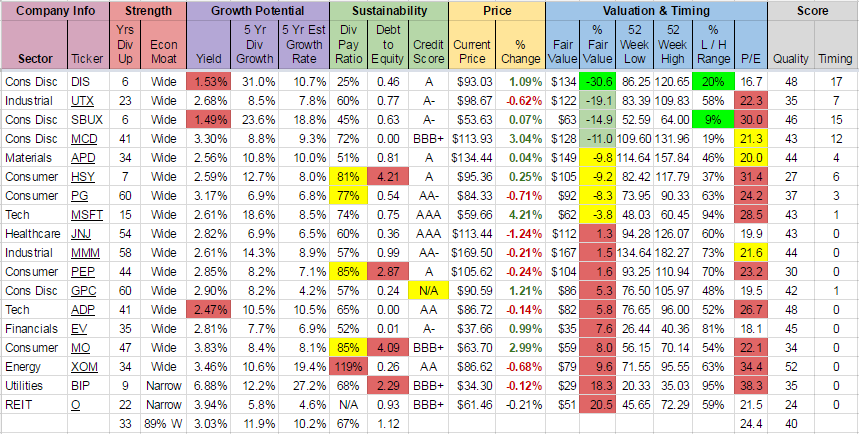

Here are the results, sorted by ‘% Fair Value’. I found 18 of the strongest dividend growth companies. I believe that adding these companies (when the time is right of course) as core positions will strengthen my portfolio. Also, I tried to include companies from as many sectors as possible for diversification, which is why not all of the companies have wide moats.

Looking at the number of consecutive years of dividend increases (3rd column) notice that most of these companies have long track records, with the list average of 33 years, of the four that are under 10 years (Disney, Starbucks, and Hershey are wide moat household brands, and Brookfield Infrastructure Partners (BIP) is lesser known, but a well diversified utility company).

Speaking of economic moats 16 of the 18 are wide (89%) meaning that they have strong competitive advantages. Dividend yield and the dividend growth rate were secondary factors in my consideration, but since these companies were taken from my watchlists they already had been vetted for income and income growth prospects. The list average came to 3.03% for dividend yield and 11.9% for the dividend growth rate, which means that this portfolio would achieve a 10% yield-on-cost in 8.6 years (assuming dividends are reinvested at the same rate). See yield to growth rate 10 x 10 score for details.

I currently own many of the companies on this list, (which DividendGeek members can view under My Portfolio > Dividend Geek Portfolio) but in most cases they are a smaller position, (weight) of my overall portfolio. Likely, because the higher the quality of a company the higher the P/E multiple it trades at, so it is more rare for the company to trade at or below fair value.

However, several of these strong dividend growers are currently trading below their fair value price. Within the past month I have started positions or increased existing positions in the top three companies trading below fair value by purchasing DIS, UTX and SBUX. I’m also considering adding to my position in MCD. Personally I plan on buying from this select group of strong companies until my portfolio is weighted at least equal with the other companies I own, naturally this is targeted to my portfolio and yours will vary.

Remember to always do your own due diligence and research before investing.

All the best,

Filed in: Dividend Geek Portfolio • Dividend Growth Investing

Great to hear from you Dividend Geek! Found one I like in this list to add to my portfolio (DIS).

Would you ever consider making a blank version of your portfolio spreadsheet available on Drive? I plan to set up something similar soon.

Yes! You can download a blank copy of my DGI Portfolio Tracker from the Download page, or just click here:

https://www.dividendgeek.com/downloads/

Thanks! Somehow I missed that. So much good stuff on this site.