2013 Results – Dividend Geek Portfolio

Happy New Year! It’s that time of year to review how well we have done towards achieving our goals and following our strategy. Notice that I didn’t say how much the market went up or if we beat the market (S&P 500 index).

Happy New Year! It’s that time of year to review how well we have done towards achieving our goals and following our strategy. Notice that I didn’t say how much the market went up or if we beat the market (S&P 500 index).

As a dividend growth investor I am focused on my ultimate objective of building a passive income machine that will exceed my expenses so that I can become financially independent and “retire”, or not have to work for my income so I can spend my time as I wish.

Yes there are many ways to possibly achieve financial freedom. You could live on a tightwad budget, build a business, trade stock for capital gains, save for years to reach your magic retirement saving number and then spend 4% of it a year and hope you don’t outlive your savings, to name a few. All are possible but not highly probable. Whereas DGI is practically a mathematical certainty due to growth and compounding over time. This is one of many good reasons, why I have chosen the DGI path to financial freedom.

That said here are the Dividend Geek Portfolio goals and results:

Dividend Income

Goal: $800

Actual: $824

My goal of $800 dividend income was based on my portfolio starting cost basis balance of $20,500 and adding $6,500 in Roth IRA contributions through out the year ($541.66 per month) returning an average dividend yield of 3.5% on both the starting balance and the new contributions. I know $800 doesn’t sound like much but it will grow quickly. I project that it will be up to $8,000 in dividend income in four years and the portfolio valued at $48,000.

I purchased $11,100 in stock this year, most of it early in the year ($8,000 by mid March) this was uninvested carryover cash from last year. Putting that excess cash to work early really helped. Of my $6,500 2013 contributions I was able to invest $3,500 so far. I still need have $3,000 cash that I need to put to work.

Let’s face it this year with the S&P 500 index rising 29.6% made it difficult to find high quality dividend growth stocks below fair value! However, by using our “Check for Undervalued Stocks” tool I was able to still find good value during the year mostly at the beginning of the year – so I struck when the iron was hot. We recently added 32 additional qualifying dividend growth stocks to our watch list to increase our chances of finding value.

Portfolio Cost Bases (cost of invested securities)

Goal: $27,000

Actual: $25,047

The goal here was to simply contribute the 2013 maximum allowable amount of $6,500 to my Roth IRA. (note 2013 IRS tax rules allow me to contribute $1,000 more than the standard $5,500 due to my uh humm age :-p). This was determined by adding my starting cost basis of $20,500 + $6,500 (IRA Contribution) = $27,000. I came up short because I still have cash to invest and I forgot to account for my dividend payments in the original goal.

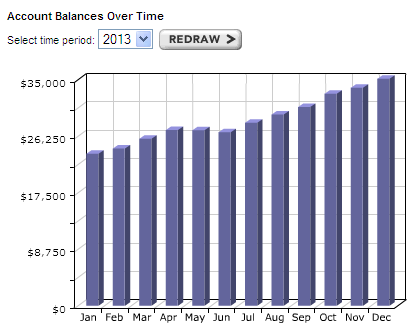

Here’s what that kind of looks like. The following chart (*Provided by E-Trade) is the market value of the Dividend Geek Portfolio which naturally includes unrealized capital gains.

Step one… goals achieved!

Well more or less I need to put some more cash to work.

But what about how well we followed our strategy?

- Portfolio averages 3.5% initial yield

- 10% dividend growth rate

- Purchase stock when near or below 20% discount to fair value

- Maintain 8%-12% sector weighted diversification

- Portfolio 90% vested (only 10% in cash)

- Reinvest all dividends during accumulation period

- Sell stock only if disruption of income stream, or the company fails to increase dividend payment for two consecutive years

In my next post I will answer that question – just how well the Dividend Geek Portfolio do at following our strategy.

BTW, Dividend Geek members can see the update Dividend Geek Portfolio by logging in and going to: My Portfolio > Dividend Geek Portfolio. If you are not a member what are you waiting for? The full service is free for 90 days (no up front credit card info requested) and the personal portfolio tracking tools are free to everyone.

All the best!

Filed in: Dividend Geek Portfolio