Announcing Dividend Geek v2.0

We are pleased to announce Dividend Geek 2.0! We have added 32 new dividend growth stocks to our existing dividend growth investment tools:

We are pleased to announce Dividend Geek 2.0! We have added 32 new dividend growth stocks to our existing dividend growth investment tools:

– Income Machine Portfolio

– Portfolio Sector Allocation

– Finding Undervalued Stocks

– Watch List Alerts

This will allow members more opportunities to find and purchase great companies when they are trading at a discount to fair value.

The majority of our original 50 dividend growth stocks were ‘conservative’ dividend growth stocks; whereas, 25 of the 32 new companies fall into the ‘aggressive’ dividend growth category. There are two types or groups of dividend growth stocks Core (Conservative) and High Growth (Aggressive). Both types core and aggressive have their place and purpose in a long-term dividend growth portfolio. Now with our 2.0 release Dividend Geek members have more great companies for consideration.

Here is a comparison of the two types:

Conservative vs Aggressive Dividend Growth Stocks

| Area | Conservative | Aggressive |

| Company Growth Phase | Mature (cash cows) | Developing (high growth) |

| Competitive Advantages (economic moat) | Strong – Wide moat | Medium – Narrow moat |

| Dividend Increases (consecutive Years) | 50-20 | 20-10 |

| Initial Dividend Yield | 5%-3% | 3%-1.5% |

| Dividend Growth Rate | 10%-6% | 11%-15+% |

| Dividend Payout Ratios | 70%-40% | 40%-25% |

| Best Portfolio Performance (compounding) | Years 1 to 15 | Years 16 to 30 |

When reinvesting (compounding) your dividends in a long-term portfolio, generally speaking conservative dividend growth stocks (with their higher initial dividend yield, and lower dividend growth rate) will outperform the aggressive dividend growth stocks for the first 15 years. However, over time the aggressive higher dividend growth companies will surpass and outperform the conservative type of dividend growth stocks (assuming they maintain their performance). Again this is generally speaking you would have to run the numbers for the exact year when this would occur.

The point is that it is good to have a mix of both types of companies. By having both conservative and aggressive dividend growth stocks in a long-term portfolio you maximize your potential retirement principle and income.

Personally I like to overweight my portfolio with a higher percentage of the stronger conservative dividend growth stocks at a 60/40 to 70/30 conservative/aggressive percentage mix.

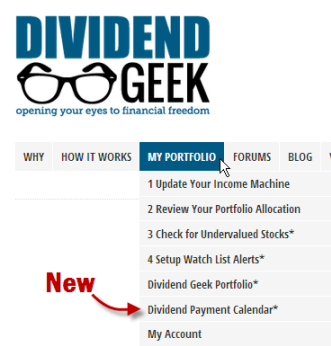

New! – Dividend Payment Calendar

We have also added a Dividend Payment Calendar to the member area which allows  you quickly look up when our recommended best dividend growth stocks pay their dividends. It also includes the month of the year when each company typically increases their payment amount.

you quickly look up when our recommended best dividend growth stocks pay their dividends. It also includes the month of the year when each company typically increases their payment amount.

It is located under the My Portfolio menu.

We hope you enjoy these new enhancements. If you happen to find anything out of place be sure to let us know and we’ll quickly make it right.

All the best!

Filed in: Dividend Growth Investing • Investment Principles • Website Tools